PRESTELLAR VENTURES

Prestellar Ventures is an early-stage private equity fund that seeks to partner with passionate entrepreneurs and disruptive startups across South Asia and ASEAN. In addition to financial investment, we provide the necessary infrastructure and guidance to help entrepreneurs shoot for the stars. Our team of proven company builders will join hands with you in all operational, strategic and financial challenges while our partner organisations will provide immense business development value. Together we can shape the future.

PRESTELLAR VENTURES

Prestellar Ventures is an early-stage private equity fund that seeks to partner with passionate entrepreneurs and disruptive startups across South Asia and ASEAN. In addition to financial investment, we provide the necessary infrastructure and guidance to help entrepreneurs shoot for the stars. Our team of proven company builders will join hands with you in all operational, strategic and financial challenges while our partner organisations will provide immense business development value. Together we can shape the future.

PRESTELLAR VENTURES

Prestellar Ventures is an early-stage private equity fund that seeks to partner with passionate entrepreneurs and disruptive startups across South Asia and ASEAN. In addition to financial investment, we provide the necessary infrastructure and guidance to help entrepreneurs shoot for the stars. Our team of proven company builders will join hands with you in all operational, strategic and financial challenges while our partner organisations will provide immense business development value. Together we can shape the future.

01

About

Us

Prestellar Ventures is a Singapore-based private equity fund seeking to partner with big-vision entrepreneurs in search of capital and mentorship. We intend to invest in companies which can benefit (i.e. enhance their sales) from the distribution network of the General Partners. The fund focuses on tech-enabled companies in the Hospitality, Consumer, Financial Services, Rural Product and Services, and Education sectors. We are promoted by the following four General Partners:

CG Corp Global

Forbes listed billion dollar multinational family conglomerate with 112 companies, 76 brands and over 10,000 employees. The group has diversified business interests including financial services, FMCG, education, hospitality, consumer electronics amongst others.

N.E.Group

A family business conglomerate based in Nepal active in various verticals including Hospitality, Consumer Goods, and Financial Services. The comapny is the chosen JV partners in Nepal for several leading multinational companies including Unilever and Religate Group.

Satin Creditcare

A publically listed top 5 largest microfinance institution (MFI) in India in terms of Gross Loan Portfolio, with over 458 branches. The company services over 2.5 million active low-income households in its network across India.

Frontline Strategies Ventures Limited

A Private Equity firm with over 15 years of experience in Indian growth capital. The company has delivered over 20% IRR over 12 years with over 15 exits across several verticals.

Our Investment

Strategy

We invest in companies with a ready team, product and recurring revenue that have the ability to disrupt industries and scale quickly.

In addition to a financial investment, we provide companies the tremendous resources and reach of the Fund’s General Partner network of companies.

The fund also specializes in taking companies to frontier territories with over 40 years of operational expertise and on-the-ground presence in markets such as India, SE Asia and the Middle-East.

Further, we provide companies with the operational and sectorial expertise of our advisory and entrepreneurial boards who are proven industry leaders and company builders

We focus on efficient scaling of businesses which leads to more attractive metrics for late-round investors.

02

Our

Team

ATIM KABRA

Partner

Atim Kabra is the Founding Partner of Frontline Strategy Limited, the investment manager/advisor for two Mauritius based India centric Private Equity funds namely –India Industrial Growth Fund Limited and Strategic Ventures Fund (Mauritius) Limited.

He has over 20 years of well rounded “equities exposure” including Portfolio Management, Equity Sales and Equity Research with global institutions like ABN AMRO Bank, ANZ Grindlays Bank.

He quit ABN Amro in 2000 to set up Frontline Strategy Limited and Strategic Ventures Fund (Mauritius) Limited. Atim has lived and worked in India (Delhi and Mumbai), and USA (New York region for 10 years). He now divides his time between India and Singapore, where he is currently based.

Atim has majored in economics from Delhi University and also has a Masters in Management Studies from Bombay University.

RAHUL CHAUDHARY

Partner

Rahul Chaudhary is the Executive Director of CG Corp Global and a director in Taj Safaris, Allila Hotels and leads the CG Hospitality vertical covering 110+ Properties and 5,000+ keys in 20 countries.

Rahul has a Bachelors of Business Administration Degree from the Miami University and PDP in Hospitality Administration/Management from the Cornell University

RABINDRA SHRESHTHA

Managing Partner

Rabindra is the Director of NE Group since August 2010.

Currently, he is also Director at Unilever Nepal, National Ice Cream Industries Pvt. Ltd, Super Religare Reference Laboratories (Nepal) Pvt. Ltd.

Prior to joining N.E. Group, Rabindra was a Financial Analyst at the Investment Banking Division of Citigroup in San Francisco, USA. Has also worked with Bear Stearns Companies, Unilever UK. Pursued B.A. in Economics from Stanford University (USA); A-Levels from Winchester College (U.K.); Other information: He is a member of Alpha Kappa Psi (Professional Business) and Kappa Alpha Order (Social)

Vipin Aggarwal

Vice President

Vipin Aggarwal is seasoned professional of proven track record in Fund Management,Fund Raising,Commodities trading,Real-Estateand Capital Markets with over 20 years experience. He has served reputed companies in his career.

He currently works as Principal Partner with a leading India Private Equity fund,India industrial growth fund. Prior to the Fund he worked (2006-2009) as Executive director Omaxe limited, a Delhi based Real estate listed company,(2001-2006) he founded India’s largest commodity broking house.

Very well networked with Global and National investors and companies; He has been instrumental in raising substantial capital for companies in the form of Debt and equity.

Vipin has been on Board of Delhi Stock Exchange in past and is currently on board of Zamil Solar (One of the largest Saudi Based industrial conglomerate) where he helped set up one of India’s largest Solar PV power plant in Gujarat. He is also on the board of SEMCO ltd a large Indian company in Defence, Railways.

A passionate angel investor, he has invested and successfully seed funded more than 25 ventures. He is an alumnus of Columbia University NewYork , IIM(A), ISB, and Kurukshetra University

Jyoti Prakash

Asst. Vice President

Jyoti Prakash has worked in a fintech start-up (BankerBay) focused on M&A/PE deal sourcing using AI. He was instrumental in scaling the venture from a very initial team to global offices and helped raise multiple rounds of funds for the venture. Prior to that Jyoti worked for an investment bank (Cap Morris) which also had a startup accelerator arm (now Revvx Accelerator). He has also worked with a Venture Capital and Private Equity Fund. Jyoti has had stints with Mindtree as a Management Consultant for their Big Data Analytics Division and as a software engineer with Accenture in their Internet of Things Lab.

Jyoti has completed his two-year MBA from IIM Lucknow and engineering from BIT Mesra, Ranchi.

Dinesh Kamath

CFO

Dinesh Kamath is the CFO of Prstellar Ventures and the Finance Controller for Frontline Strategy Limited.

He has over 17+ years of experience in the finance & accounting and audit & tax functions of corporates. At Frontline Strategy, he has handled the statutory, accounting, regulatory and legal compliances. He has experience in interacting with Banks and financial institutions in India for structured debt products.

He has a Bachelors of Commerce degree from Bombay University, and is also a Graduate Cost & Works Accountant

04

What's

New

PRESTELLAR VENTURES INVESTS IN TECHNOLOGY ENABLED STUDENT HOUSING START UP PLACIO

Placio, a Noida-based technology-enabled, student housing properties management start-up, has inked pact with Prestellar Ventures, a Singapore-based private equity fund for US$ 2 million to provide superior student living experience in India and South-East Asia

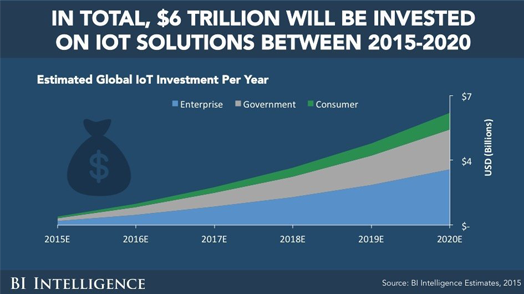

THE IOT 101 REPORT: YOUR ESSENTIAL GUIDE...

Lorem ipsum lectus Aliquam orci nisi. Sagittis non nibh lectus. Aptent nibh mi. At sit aptent a odio.

MICROSOFT, GOOGLE LEAD IN AI PATENT ACTIVITY…

You’ve likely heard the phrase Internet of Things, or IoT, at some point if you have been following…

THE PROMISING STARTUP DOMAIN OF 2017

2016 was the year of AI, as financing to startups in the field rocketed to a record…

WHAT WILL BE THE DRIVING FORCE FOR STARTUPS…

India is going through the second phase of growth in startups, now referred to as Startup 2.0..

05

Pitch

We want to hear about your vision, passion and ideas! Let’s build the future together!

06

Feeds

07

Contact

We’d love to hear from you!